New and potential business owners should take care when selecting their business entity structure. How you and your business will be taxed is wholly dependent on the entity structure you select. Not only do you need to consider both your current and future tax outcomes, you also need to ensure that your entity serves the needs of your business partners and investors. Because so much rides on your business entity structure, make sure that you are well informed before you make your selection.

Legal vs. Tax Entity

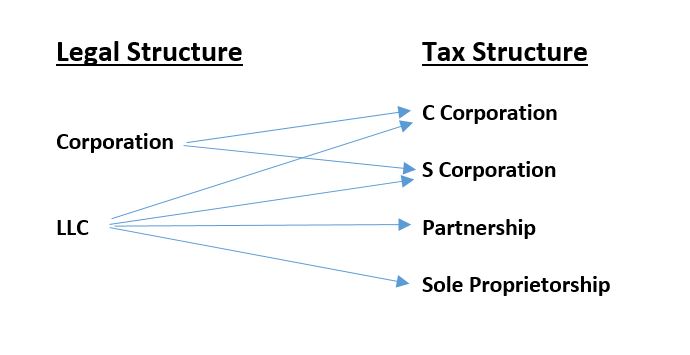

Ideally, taxpayers will consult both a lawyer and an accountant before they select their business entity structure because a business’s legal structure will influence its tax structure. In the U.S., most new businesses form as Corporations or as Limited Liability Companies (LLCs) (although Limited Partnerships, Professional Associations and Limited Liability Partnerships are also common legal structures). Corporations are taxed either as C corporations or S corporations, and LLCs can be taxed as sole proprietorships, partnerships, C corporations or S corporations. To select your ideal legal structure, you should understand the tax implications of all four tax structures.

Sole Proprietorship

The only way that your business can be taxed as a sole proprietorship is if you are the sole owner of your business. You can organize yourself as a single-member LLC with your state, or you can remain unincorporated. Either way, you will report your business’s income and expenses on your personal income tax return.

Tax Considerations

Sole proprietorships are not independent entities in the eyes of the IRS. You will report your business’s income and expenses alongside any other earned or unearned income that you have. You will report your business information on Schedule C, Profit or Loss from Business (Sole Proprietorship), which will flow to page 1 of your personal tax return (Form 1040). The taxes for sole proprietorships are easy to calculate, but you may miss out on business deductions that you would be eligible for if you filed using any of the other three tax structures.

Partnership

LLCs are not universal legal entities across all 50 states, but most states have a legal structure that provides similar protections and opportunities to its owners. If you organize your business entity structure as an LLC, you and your co-owners will file your taxes as a partnership unless you elect to be taxed as a corporation. If you file as a partnership, there are a few things you should know.

Tax Considerations

Like sole proprietorships, partnership income and expenses will be reported on each owner’s individual income tax return. Unlike sole proprietorships, the IRS requires partnerships to file a separate tax return for their businesses first. Partnership income and expense should be reported on Form 1065, U.S. Return of Partnership Income.

The business’s income and deductions as reported on Form 1065 will be divvied up among the partners per the partnership agreement. The allocation does not have to be proportional to each partner’s ownership; the partnership agreement can state that Partner A reports 100% of the income and 80% of the expenses while Partner B reports 0% of the income and 20% of the expenses, if that is what the partners agree to. This sort of freedom can be an invaluable part of your tax plan, but you will need a good team of CPAs to help you with the reporting complexities.

C Corporation

If you legally incorporate your business or make a certain election as an LLC, you will file your tax return as a C corporation. C corporations are not a common business entity structure for most new businesses. C corporations are administratively burdensome compared to other tax entities, and founders have less control over the entity as it grows.

Tax Considerations

C corporations are the only tax entities that will report and pay their own taxes. They will report their income on Form 1120, U.S. Corporation Income Tax Return. Business owners will only pay taxes on (1) salaries and bonuses that they receive (assuming they are also employees of the business), and (2) dividends they receive as stock owners.

Double taxation can be one of the biggest downsides of C corporations. Double taxation occurs when a business’s income first gets taxed by the corporation (on Form 1120) and then by the individuals when they are awarded dividends (on Form 1040).

S Corporation

To avoid double taxation and some of the clerical burdens that come with C corporations, many small business owners elect to be taxed as S corporations instead. For a corporation to file their taxes as an S corporation, they must make what is known as an “S election.” To make an S election, you and your CPA will file a simple form with the IRS. For an LLC to file as an S corporation, they must first check the appropriate box to file as a C corporation, and then immediately make an S election. Both elections are easy to make and very common. The timing of the S election can be a bit tricky, so make sure you talk to your accountant before you begin business operations.

Tax Considerations

S corporations file their business information on Form 1120-S, U.S. Income Tax Return for an S Corporation. Just like sole proprietorships and partnerships, S corporations pass business income down to their owners/shareholders. Business income, deductions, gains and losses must flow down to the shareholders in proportion their relative investment. This limitation and a few other operational requirements make S corporations less flexible than partnerships.

Make Your Selection

Settling on one ideal business entity structure is easier said than done. The pros and cons of each may never reveal an obvious “best option.” But your CPA can help you make that determination. Every year, our CPAs guide small businesses through this entity selection process, and we would be happy to help you navigate. Contact us today if you need help.