When it comes to owning a farm, every dollar matters

Keep more in your wallet when you work with Landmark. We know the unique tax implications of the farming industry, including state-specific agriculture tax credits. We stay up to date with evolving regulations from the Department of Agriculture (USDA), Food and Drug Administration (FDA), and the Environmental Protection Agency (EPA), helping you stay compliant.

We don’t just file your tax return, we’re here to empower you to understand your farm’s financial projections. So you can make smart business decisions, maintain operations, and keep your farm in the family for generations to come.

Let us handle your farm accounting needs:

50+

Agriculture clients served

2

Firm partners who own farms

60+

Years serving clients

Team

We have an entire team dedicated to farm accounting services

Meet Our TeamMeet the firm partners who lead our agriculture industry team

- Budgeting and cash flow planning

- Business valuation and litigation support

- Buy / lease agreement development

- Buy / sell agreement preparation

- Compensation, benefits, and incentive planning

- Corporate governance services

- Cost segregation studies

- Due diligence research and review

- Financial planning

- Financial statement audits, compilations and reviews

- Inventory control process development

- Mergers and acquisition facilitation

- Profitability analysis

- Research and experimental tax credit studies

- Strategic planning

- Succession planning and exit strategy

- Tax methods of accounting

Let our advisors handle your farm accounting needs:

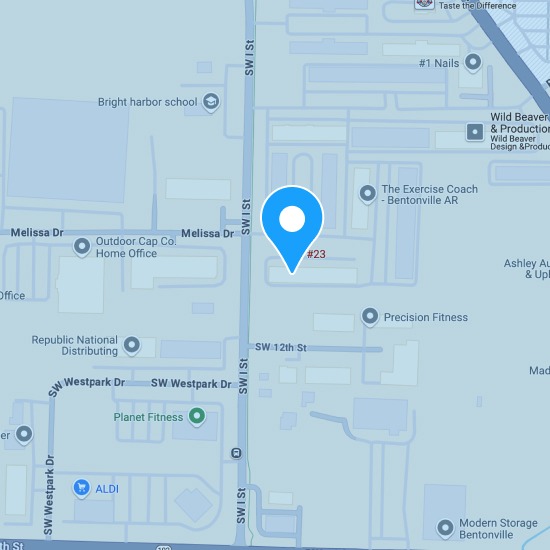

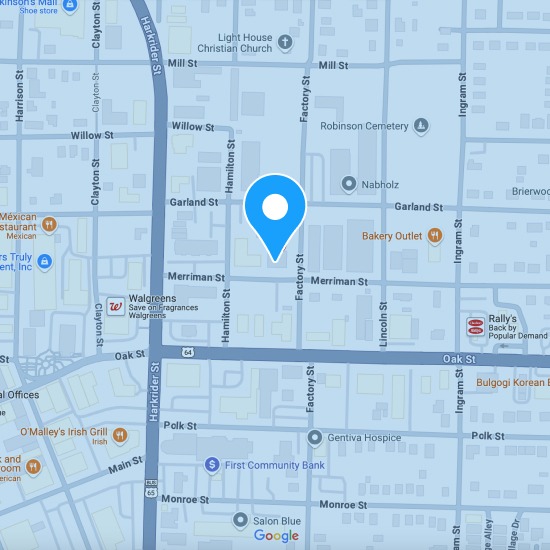

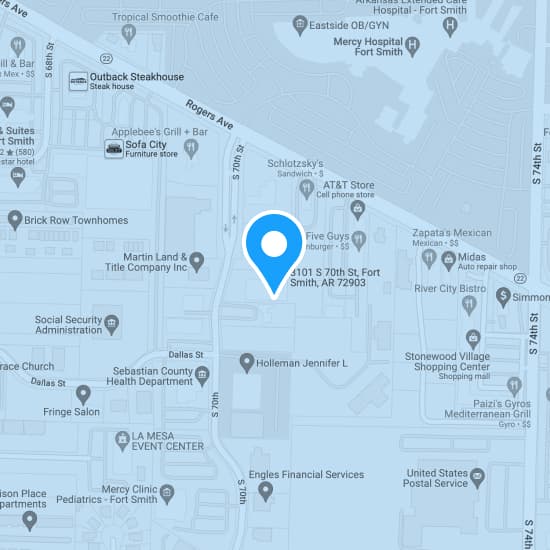

Locations We Serve

Landmark serves clients locally and nationwide from our 9 offices across Arkansas and Arizona.

Arkansas Farm Accounting Services

Little Rock, AR

200 W. Capitol Ave., Suite 1700

Little Rock, AR 72201

(Inside the 200 West building)

501.375.2025

Learn more

Arizona Farm Accounting Services

Across the United States

1.800.825.3608

Are you located outside of Arkansas or Arizona? No matter where you call home, we provide farm accounting services to agriculture clients across the United States.

Featured Insights

Explore our insights.